This article was originally published in Waste and Recycling Magazine on February 4, 2025

In 1970, British Columbia made history as the first jurisdiction in the world to implement a mandatory deposit return system (DRS) for single-use beverage containers. Fast forward to today and nearly every province and territory in Canada has implemented a DRS, a collection system designed to incentivise recycling by adding a refundable deposit to the price of beverage containers, which can be redeemed by consumers when they return empty containers to designated collection points.

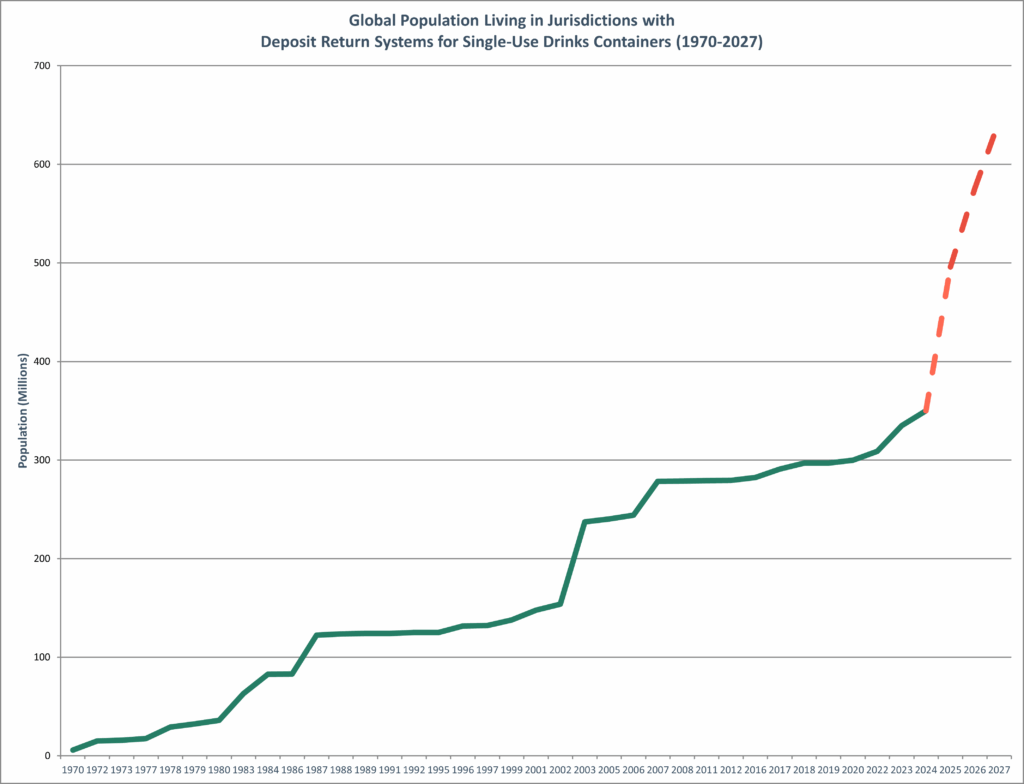

Beyond Canada, the adoption of DRS is gaining momentum as governments worldwide recognise their effectiveness in boosting recycling rates and addressing global challenges like plastic pollution and climate change. As of January 2025, nearly 357 million people across 57 jurisdictions have access to deposit systems. This number is expected to grow significantly, with projections estimating that by the end of 2027, approximately 641 million people will be covered by DRS in 70 jurisdictions (Figure 1).

In the coming years, new programmes are set to launch in several countries and regions, including Poland (October 2025), Türkiye (2025), the Australian state of Tasmania (2025), the Czech Republic (2026), Singapore (2026), Spain (2026), Portugal (2026) and the four nations of the U.K. (2027).

This rapid expansion in DRS is just one of the key findings in the fifth edition of Reloop’s Global Deposit Book 2024, released in December. Since its first publication in 2016, the report has been widely regarded as the most comprehensive resource on deposit systems worldwide, offering in-depth insights into each system’s legislative framework, collection infrastructure, financing model, operational structure, and—critically—performance data.

With this global context in mind, the question arises: How does Canada measure up in its efforts to collect and recycle single-use beverage containers?

How well do Canadian programmes perform?

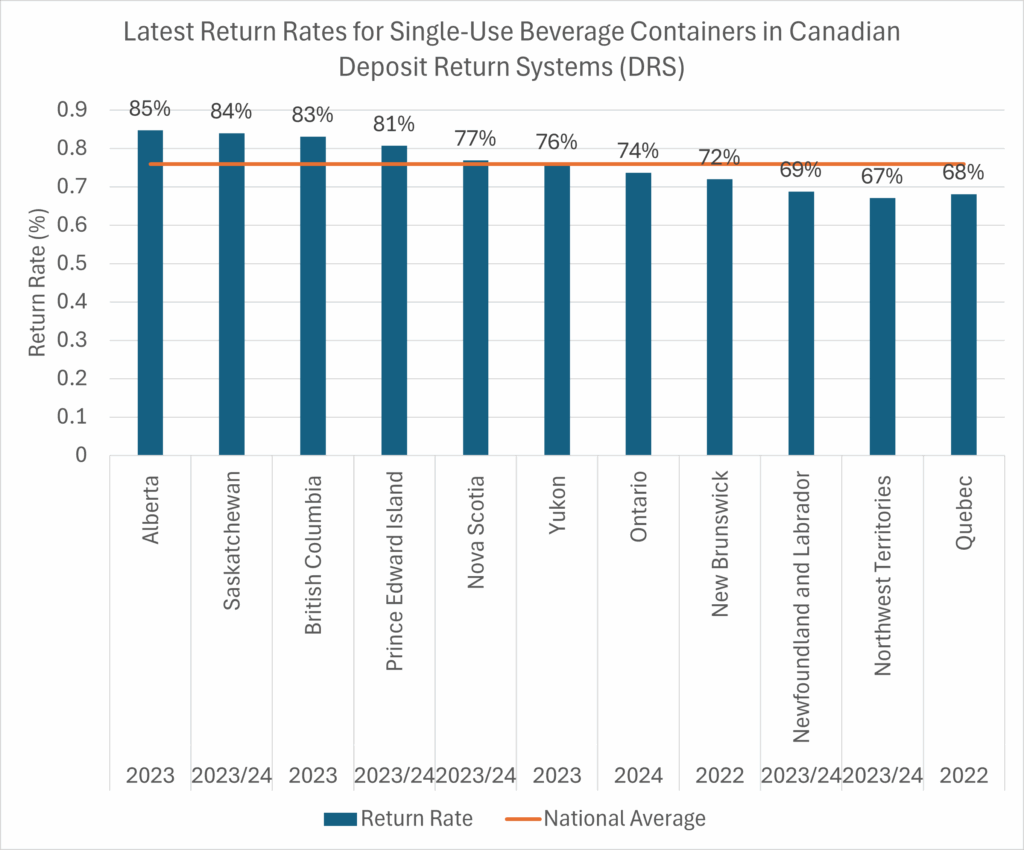

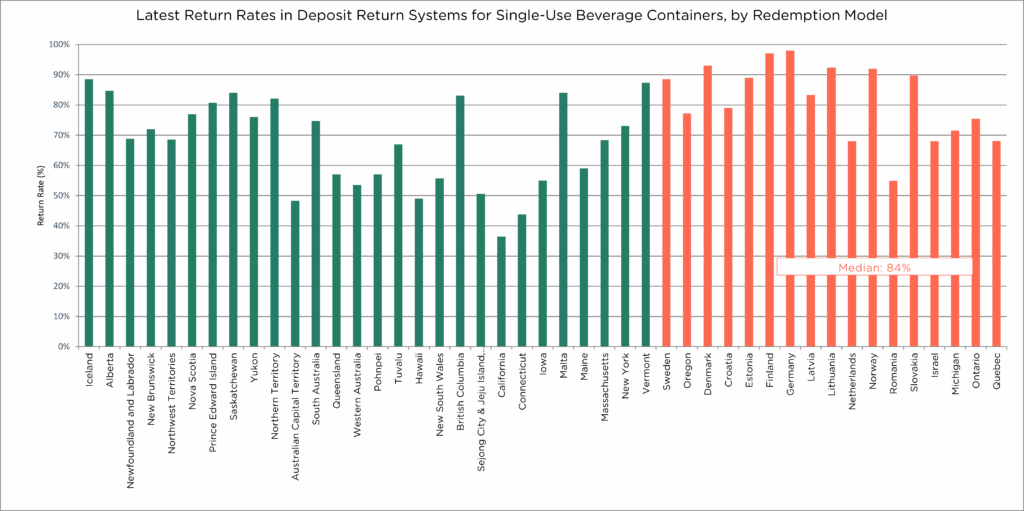

In 2023, Canadian deposit return systems achieved an average return rate of 76% for single-use beverage containers—14-percentage points higher than the U.S. national average. Leading the charge was Alberta, with an overall return rate of 85%, followed closely by Saskatchewan at 84% and British Columbia at 83% (Figure 2).

While Canadians have much to be proud of when it comes to beverage container recovery, there is much room for improvement. Reloop’s What We Waste Dashboard reveals that between 2015 and 2024, Canadians wasted an astounding 56 billion beverage containers that could have been recycled, including 7.8 billion glass bottles, 20.6 billion metal cans, and 27.5 billion plastic PET bottles. This equates to an average of 5.6 billion containers wasted every year—enough to fill Toronto’s CN Tower almost nine times. The economic and environmental costs of this waste are significant: an estimated $842.2 million worth of valuable materials was lost, and 3.9 million tonnes of unnecessary carbon emissions were generated. These emissions are equivalent to burning over 2 million metric tonnes of coal or consuming 1.7 billion litres of gasoline.

Reloop’s Global Deposit Book reveals that several countries achieve DRS return rates exceeding 90%, demonstrating that even Canada’s top-performing programmes have untapped potential. This gap is particularly concerning given projections that if collection for recycling rates for glass, metal, and PET beverage containers in Canada remain unchanged, it is projected that from 2025-2029, over 30 billion units of glass, metal, and PET beverage containers will be wasted, contributing further to material loss and environmental harm.

How can Canadian province and territories close the gap?

By learning from leading deposit return systems worldwide, Canadian DRS programmes can adopt proven strategies to boost return rates and reduce waste. The Global Deposit Book highlights three key factors that influence performance:

Deposit values

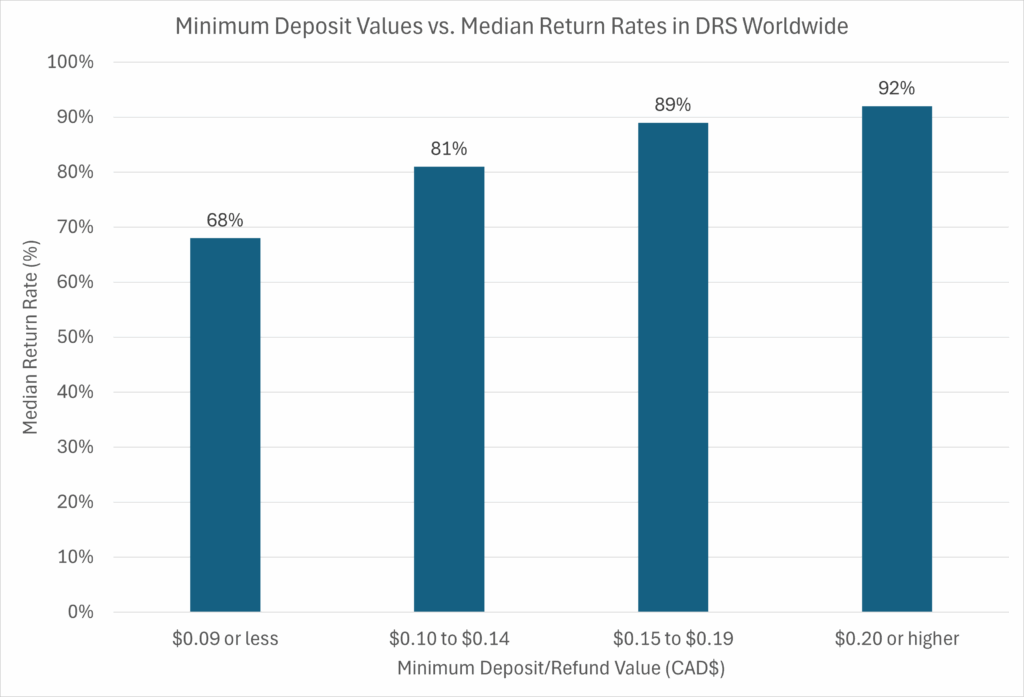

The evidence is clear: higher deposit values are strongly correlated with higher return rates. Reloop’s analysis of global DRS programmes shows that jurisdictions with minimum deposits of less than CAD $0.10 achieve a median return rate of just 68%, while systems with deposits of CAD $0.20 or more reach a median return rate of 92% (see Figure 3).

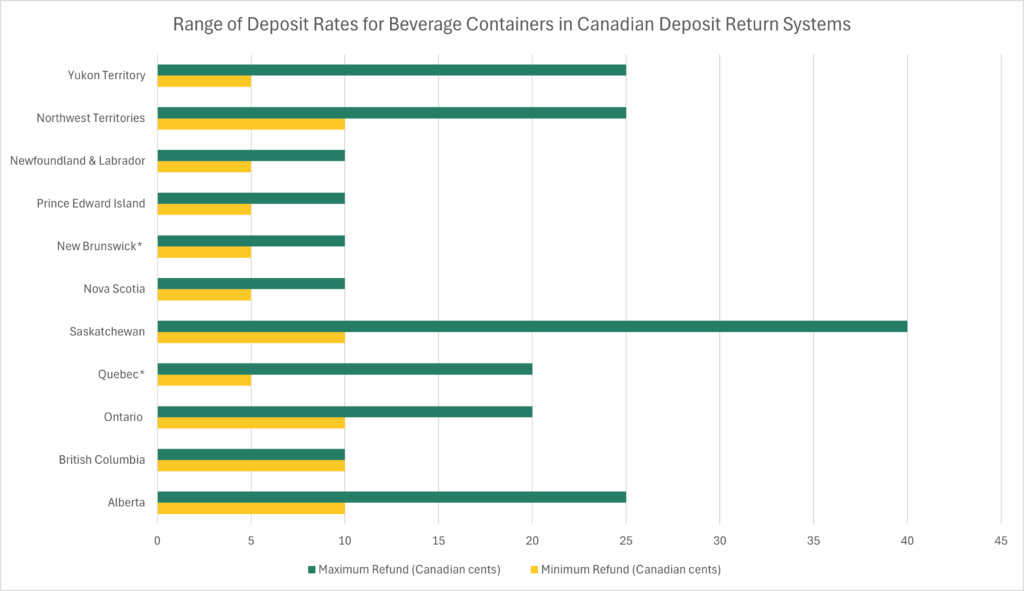

In Canada, deposit values are significantly lower than in top-performing systems internationally. Figure 4 shows the range of deposit values in each province and territory as of January 2025 (with Quebec and New Brunswick data reflecting 2022 deposit values due to the availability of return data). While the top three performing programmes in Canada—Alberta, Saskatchewan, and British Columbia—have a minimum deposit of $0.10, six out of 11 Canadian DRS still rely on minimum deposits of just $0.05.

By comparison, leading European systems have much higher deposits. In Germany, the minimum deposit is CAD $0.37; in Norway, it ranges from CAD $0.25 to $0.38. Finland and Denmark impose similarly high deposit rates, ranging from CAD $0.15 to $0.59 and $0.20 to $0.60, respectively. These higher rates have helped achieve return rates exceeding 90%.

The impact of inflation

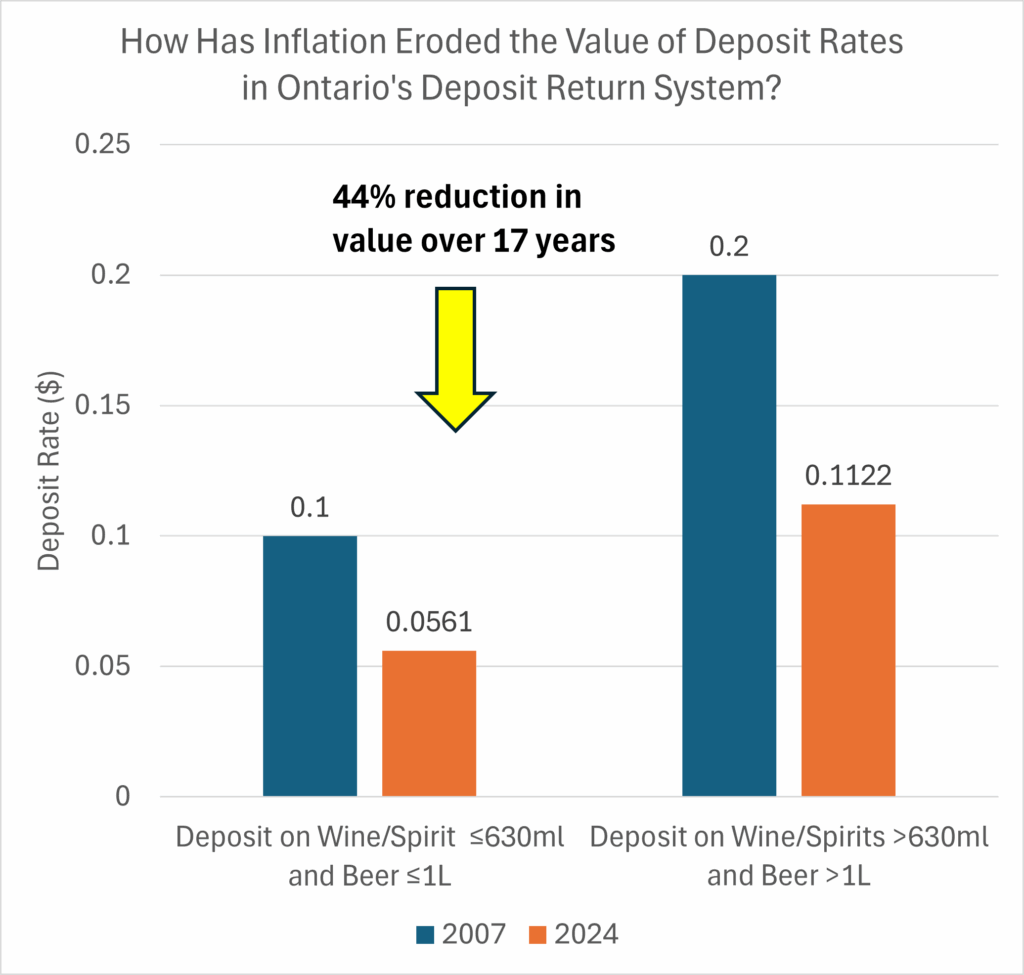

Another challenge is the stagnation of deposit values across most Canadian provinces and territories. Many programmes have not adjusted their deposit rates for years—or even since their inception—resulting in a steady erosion of their real value due to inflation. This decline weakens the incentive for consumers to return containers, as the perceived reward no longer outweighs the effort required.

Figures 5 and 5a illustrates how Ontario’s deposit values, set in 2007 at $0.10 (for wine and spirits ≤630ml and beer ≤1L) and $0.20 (for wine and spirits >630ml and beer >1L), would compare today if adjusted for inflation. To maintain their original purchasing power in 2024 dollars, these deposits would need to rise to $0.14 and $0.29, respectively. In other words, their real value has dropped to just$0.056 and $0.112—representing a 44% decline in value.

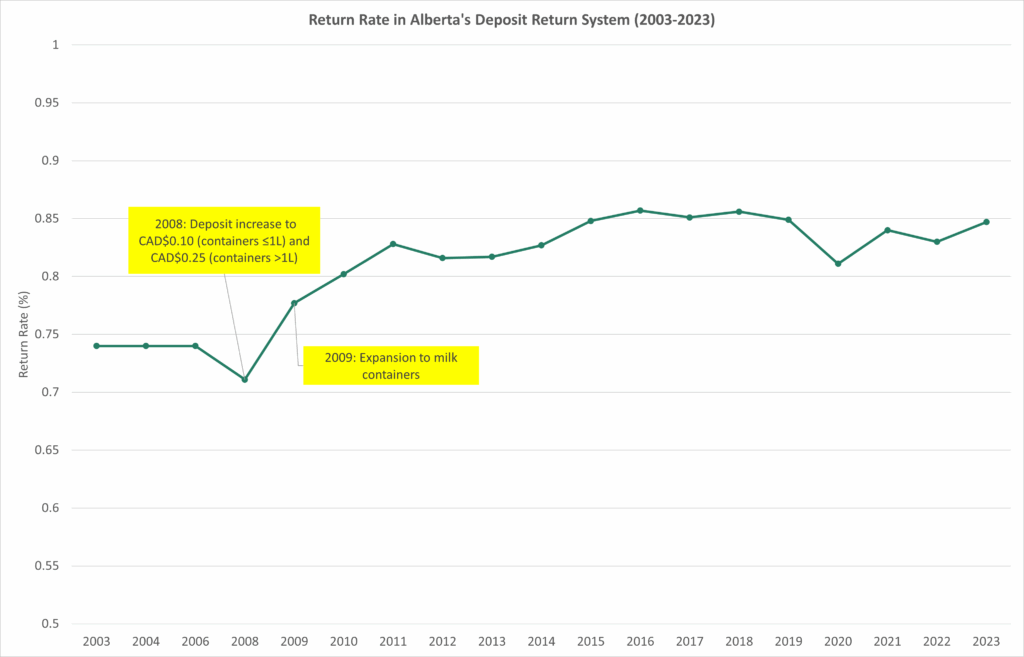

This devaluation underscores the need to periodically review and adjust deposit rates to reflect inflation, ensuring they remain effective in driving consumer participation and maximising return rates. Alberta provides a compelling case study of the impact of increasing deposits on return rates. When it increased its deposit at the end of 2008, the result was a 10 percentage-point increase in the overall return rate by the end of 2009 (Figure 6).

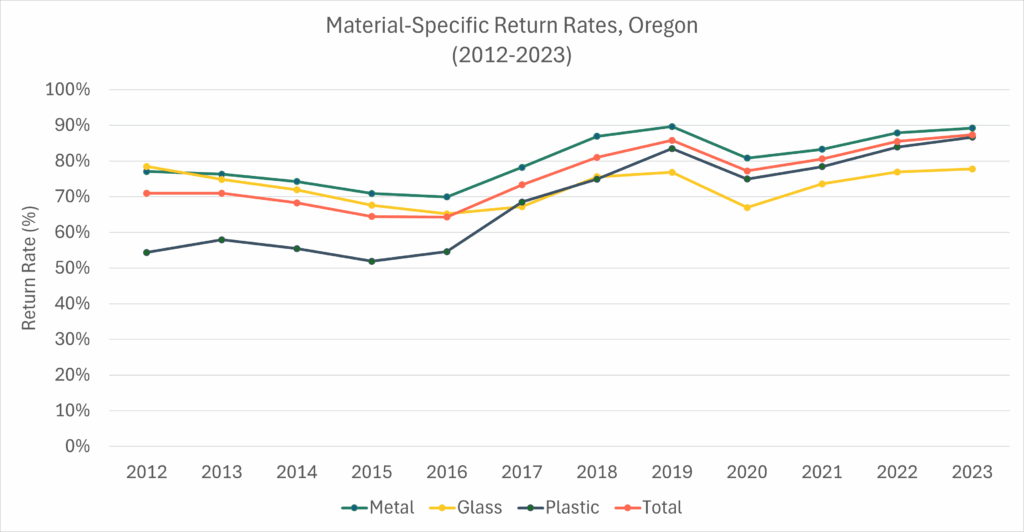

Both Oregon (US) and Norway offer additional evidence of the positive impact of deposit values on return rates. In Oregon, return rates had stagnated at around 60% between 2014 and 2016. However, in 2017, the state doubled its deposit from USD$0.05 to USD$0.10, resulting in a remarkable turnaround. By the end of that year, the return rate had surged to 73%, eventually reaching 86% by 2019.

In September 2018, Norway implemented a doubling of its deposit rates, raising the fee for containers under 500ml from 1 NOK (CAD$0.13) to 2 NOK (CAD$0.26) and for containers over 500ml from 2 NOK (CAD$0.26) to 3 NOK (CAD$0.38). This adjustment had an immediate and significant impact: within two years, return rates surged across all material types. The return rate for cans increased from 84% in 2017 to 93% by 2020, while plastic bottles rose from 88% to 92%. Overall, the system’s return rate climbed to 92% in 2020, up from 87% in 2017.

Recognising the importance of deposit values in driving higher return rates, a number of other provinces including New Brunswick and Quebec have increased deposits in recent years, and PEI is also considering increasing its rates[2] pending legislative approval this Spring.

Ease of container return and accessibility: Next to deposit values, the convenience of return – that is, how easy it is to return empty containers to designated collection points – also plays a critical role in system performance. Reloop’s research shows that jurisdictions that utilise a return-to-retail (R2R) model — where retailers are legally required to accept container returns and provide refunds — achieve a median return rate of 84% (Figure 9). This is significantly higher than the 69% median return rate in jurisdictions that rely on depots or hybrid models, where depots operate alongside retail stores.

In Canada, most deposit return systems operate under a return-to-depot model, where consumers must bring empty containers to standalone depots to receive their deposit refunds. Ontario is the only province with a R2R model. However, until recently, this model had limited take-back obligations, restricted to The Beer Store outlets and licensed agency stores.

As of October 31, 2024, grocery stores larger than 4,000 square feet that sell alcohol are also required to accept empty alcohol containers during their alcohol sale hours. Some grocery stores located within 5 km of a Beer Store location are temporarily exempt from this requirement until January 1, 2026. After this date, all eligible grocery stores selling alcohol must accept returns and provide deposit refunds. While The Beer Store outlets accept all container types, grocery stores are only required to accept the types they sell.

Quebec previously operated a true R2R model but transitioned to a hybrid system in November 2023 as part of its DRS modernisation plan, adding consignment depots to its collection network. British Columbia also uses a hybrid model, combining depots with retail return points. Hybrid and depot-based systems are generally less convenient than R2R systems, which allow consumers to return containers at the same locations where they shop, making the process more accessible and user-friendly.

Canadian DRS programmes also face challenges related to the accessibility of collection points. Compared to leading international systems, the population served by each collection point in Canada is significantly higher, as shown in Table 1. Among the top six performing international systems, the population per collection point ranges from 1 collection point per 370 people to 1 per 1,644 people. In contrast, Canadian programmes serve much larger populations per collection point. This disparity means that Canadian often need to travel further to redeem their containers, creating an additional barrier to participation.

This issue is compounded by the fact that depot systems typically rely on customers bringing their containers by car; this automatically excludes a growing number of city dwellers without access to a vehicle. A 2024 survey of Albertans conducted by the Beverage Container Management Board highlights this disparity, showing that reported redemption is significantly higher among those who own a vehicle (92%) compared to those without access to one (66%).

There’s also the fact that Canadian programmes continue to rely on manual collection processes rather than automated systems like reverse vending machines (RVMs), which are common in high-performing systems. Manual collection is typically slower and less convenient for consumers, further diminishing the appeal of returning containers. Together, these factors—limited accessibility and slower processes—undermine the convenience and overall efficiency of Canadian DRS programmes, ultimately affecting return rates.

| Redemption Model | Number of Collection Points | Population per Collection Point | Method of Return | |

|---|---|---|---|---|

| Norway | Return-to-retail | 15,000 | 370 | 94% automated, 6% manual |

| Denmark | Return-to-retail | 13,292 | 448 | 90% automated, 10% manual |

| Germany | Return-to-retail | 130,000 | 642 | 90% automated, 10% manual |

| Lithuania | Return-to-retail | 2,600 | 1,110 | 91% automated, 9% manual |

| Finland | Return-to-retail | 4,000 | 1,401 | 97% automated, 3% manual |

| Slovakia | Return-to-retail | 3,300 | 1,644 | 72% automated, 28% manual |

| Alberta | Return-to-depot | 221 | 21,945 | Mostly manual |

| Saskatchewan | Return-to-depot | 73 | 16,864 | 100% manual |

| Nova Scotia | Return-to-depot | 77 | 13,929 | 100% manual |

| Prince Edward Island | Return-to-depot | 13 | 13,622 | 100% manual |

| New Brunswick | Return-to-depot | 73 | 11,656 | 100% manual |

| Newfoundland and Labrador | Return-to-depot | 53 | 10,215 | 100% manual |

| Yukon | Return-to-depot | 14 | 3,268 | 100% manual |

| Northwest Territories | Return-to-depot | 29 | 1,549 | 100% manual |

| British Columbia | Hybrid | 2,562 | 2,204 | Mostly manual |

| Ontario | Return-to-retail | 1,706 | 9,377 | Mostly manual |

| Quebec | Old system (prior to 1 Nov 2023): Return-to-retail New system (as of 1 Nov 2023): Hybrid | 8,010 | 1,127 | Old system (prior to 1 Nov 2023): 82% automated/18% manual New system (as of 1 Nov 2023): mostly automated (collection is automated at all depot sites as well as large retailers) |

Program scope: Deposit return programmes with broad scopes—including a wide range of beverages, container types, and sizes—tend to achieve higher return rates. This is because they minimise confusion about which containers are eligible for refunds, making participation easier and more intuitive. Alberta provides a compelling example: as Canada’s top-performing DRS in 2023, its programme includes all alcohol, non-alcohol, and cannabis beverages, with no exclusions—not even milk—and accepts all container types of 50 litres or less.

In contrast, many Canadian DRS programmes exclude key container categories, which limits their effectiveness. While most programmes accept all container materials (e.g., plastic, metal, glass, aseptic containers, cartons), some exclude significant segments such as non-alcohol beverages (e.g., Ontario) or non-carbonated beverages like milk (e.g., Atlantic provinces). These exclusions significantly reduce the volume of recyclable materials captured, undermining recovery rates and the overall impact of the programmes (Environmental Defence Canada estimates that over 1.7 billion plastic bottles are littered, landfilled, or incinerated annually because Ontario lacks a DRS for non-alcohol beverages). Expanding programme scope to include these containers offers an opportunity to increase recovery rates and divert more packaging waste from landfills and incinerators.

A real-world example of the benefits of widening programme scope is New York. When the state added water bottles to its DRS in 2009, the number of PET plastic containers returned for recycling doubled, according to a 2021 report.

Recent developments in Quebec further illustrate the potential of broadening a programme’s scope. Until recently, Quebec’s DRS was limited to soft drinks and beer in plastic, metal, and glass containers. Phase 1 of the system’s expansion (November 2023 to February 2025) extended coverage to all ready-to-drink beverages, including wine, spirits, fruit drinks, juices, milk, and both flat and sparkling water in metal containers. Initially, the programme was set to expand further on March 1, 2025 to include glass and multi-layer cartons for beverages such as wine, spirits, cider, milk, and juice.

However, in November 2024, the provincial government announced a delay for deposits on glass and multi-layer packaging, which will now take effect in March 2027. Deposits on all plastic ready-to-drink containers from 100ml to 2L will still proceed as planned in March 2025. When fully implemented, the Quebec government anticipates that these changes will more than double the number of containers covered by the deposit system, substantially increasing recovery rates and diverting additional materials from landfills and incineration.

Encouragingly, public support for broader DRS programmes is strong. A 2024 Abacus Data poll found that 81% of Ontarians favor expanding the province’s DRS to include all beverage containers. Unfortunately, recent efforts to expand Ontario’s programme have stalled; in the summer of 2024, the provincial government abruptly cancelled work on such an expansion after retailers objected to being required to accept returns of empty beverage containers.

What do Canadians have to lose?

If collection for recycling rates for glass, metal, and PET beverage containers in Canada remain unchanged, it is projected that from 2025-2029, 30.5 billion glass, metal, and PET beverage containers (equal to 1.4 million tonnes) will be wasted.

If a national best-in-class DRS—designed to achieve a 90% return rate—were implemented across Canada today, Reloop predicts that from 2025-2029, an additional 16.8 billion units of glass, metal, and PET beverage containers would be recycled rather than wasted in Canada. That number represents approximately 727,386 tonnes of beverage containers. Recycling this material would result in 963,343 tCO2e of avoided emissions, equivalent to not burning 485,388 tonnes of coal, or not consuming 410.3 million litres of gasoline.

The clear path to higher beverage container recovery in Canada

Canada’s beverage container recycling system is at a critical juncture. With recycling rates stagnating and valuable materials being lost to landfills and incineration, reform is essential. Deposit return systems modeled after global best practices offer a proven solution to these challenges.

Provinces like Ontario—Canada’s most populous—and Manitoba illustrate key areas for improvement. Both provinces lack deposit programmes for non-alcoholic containers, highlighting a significant gap in coverage. Expanding existing programmes to include containers like milk, raising deposit values, and enhancing consumer accessibility through mandatory return-to-retail provisions are critical steps to improving recovery rates.

By modernising its deposit programmes, Canada could recover an estimated $216 million (at 2024 prices) in material value that would otherwise be lost from 2025-2029, while significantly increasing recycling rates. Aligning with international best practices and addressing gaps in programme design—particularly in Ontario and Manitoba—would propel Canada toward a more effective and competitive recycling system, helping the country lead in the global shift to a circular economy.

Samantha Millette is Reloop’s Research and Analysis Manager.

samantha.millette@reloopplatform.org.

Clarissa Morawski is the CEO and co-founder of Reloop.

clarissa.morawski@reloopplatform.org.